The ongoing energy price crisis has sparked serious debate on solutions to reduce energy consumption, enhance energy efficiency, and accelerate the shift away from fossil-fuel based heating systems currently dominating space heating in European buildings. Cleaner and more efficient technologies are already commercially available, but require faster rates of deployment. To trigger wider uptake, innovative business models such as servitisation or the ‘pay-per-use’ approach are now being deployed and explored.

Last year, BASE launched the global SET Alliance (Servitisation for the Energy Transition Alliance), with the objective to mainstream the ‘as-a-Service’ approach to drive energy efficiency. Today, Cooling-as-a-Service has gained significant traction worldwide, particularly for commercial and industrial applications. But what about when it comes to Heat-as-a-Service (HaaS)?

To understand more about the emerging landscape of the heating market and the challenges and opportunities associated with HaaS propositions, the SET Alliance spoke to LCP Delta’s Heating Business Service Research Manager Klara Ottosson, and New Energy Business Model Analyst Arthur Pereira.

What is LCP Delta’s role in the energy transition and the market for heating?

LCP Delta is a consultancy practice focused entirely on accelerating the energy transition mainly in Europe but with activity worldwide. We provide data, primary research, insights, analysis and models embracing advanced technology and innovation across the whole energy value chain to the industry to provide a better, faster energy transition for all. We provide leading market advice through our four product offerings: Subscription research to specific topics, consulting, technology & data, and training.

LCP Delta’s research on the heating transition ranges from tracking and reporting on policy and regulatory change, identifying key heating technologies and forecasting their growth, as well as exploring how routes to market are evolving, and how the role of the customer is changing. This research enables our clients, heating sector stakeholders, to stay up to date with the latest developments of the heating transition and identify key opportunities.

“It is no longer business as usual and heating

sector stakeholders need to adapt quickly.”

The transition from ‘old heat’ to ‘new heat’ and focus on decarbonisation is disrupting the market, and the evolving landscape can be difficult to navigate. Governments are recognising that heating and cooling form a huge share of emissions, resulting in greater policy surrounding decarbonisation and stricter regulations coming into force. More recently, the energy price crisis has led to increased customer awareness of their energy consumption, and more than ever before, customers are making conscious decisions to reduce energy use and find more efficient and sustainable solutions. It is no longer business as usual and heating sector stakeholders need to adapt quickly.

How does Heat-as-a-Service fit within the work you do?

Heat as a Service (HaaS) and more generally ‘X-as-a Service’ offerings fall within a category of advanced propositions emerging from the energy transition which LCP-Delta closely monitors. Looking at the energy sector as a whole, it is evident that the traditional approach of treating energy as a commodity and the conventional supply model is rapidly becoming less sustainable. Over the past five years, we have witnessed an unprecedented number of energy suppliers folding; unable to adapt to the ongoing transition. This has left remaining suppliers feeling apprehensive and uncertain about their role in the evolving energy system.

Customers who have struggled in the last couple of years are losing faith in the traditional supplier model and want solutions that provide them with more control and offer protection from the volatility of energy prices. By collaborating closely with customers, suppliers can address their needs and regain their trust. The shifting landscape presents an opportunity to rebuild the relationship between suppliers and customers by transforming propositions from commodity sales to energy services.

Our primary interest lies in comprehending the motivations, barriers, and drivers of customer adoption across residential, commercial, and industrial segments. We provide analysis on potential business models to guide our subscribers in developing attractive offerings aligned with the growing service-based energy market. These can be complete “as a service” propositions or less complex solutions, for example providing project finance and monitoring.

“The shifting landscape presents an opportunity to

rebuild the relationship between suppliers and

customers by transforming propositions from

commodity sales to energy services.”

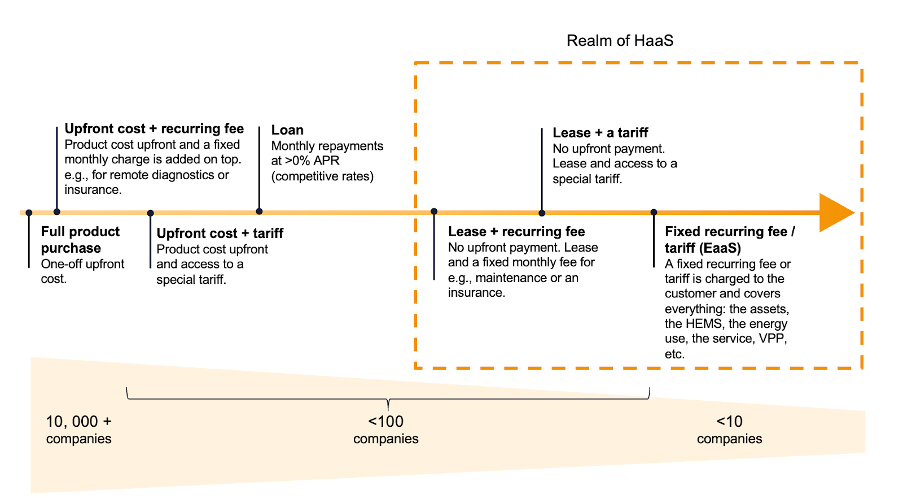

LCP Delta, May 2023. Financing options, transitioning from commodity sales toward energy services.

What are some of the barriers to HaaS propositions in the residential space versus commercial and industrial applications?

As a general rule, the more components and services that are included in a HaaS proposal, the more complexity and need for careful assessment of the risks and rewards. However, successful HaaS suppliers stand to benefit from recurring revenue, closer customer relationships and greater possibility for repeat business at the end of appliance life.

Residential

Barriers fall into two categories: the added complexity and work for providers, and the (currently) limited customer appetite. While HaaS is a profitable business model for technology providers, it typically takes longer to realise profits (see swallowing the fish) and requires taking on different risks depending on the scope of the proposition and the inclusion of energy supply. Providing HaaS involves financial risk stemming from the provision of heating appliances at no upfront cost; although reported default from active propositions is low, the risk of default cannot be ignored. Technical risk comes from the range of services typically comprising: routine maintenance, repairs and even replacement in case of breakdown. Including energy supply in the monthly fee brings additional risks to consider related to appliance performance, customer behaviour and energy price. Few providers are currently pursuing such propositions, with most active HaaS propositions falling into the appliance leasing or renting category (see the graphic above).

“Successful HaaS suppliers stand to benefit from

recurring revenue, closer customer relationships

and greater possibility for repeat business when

appliances reach end of life.”

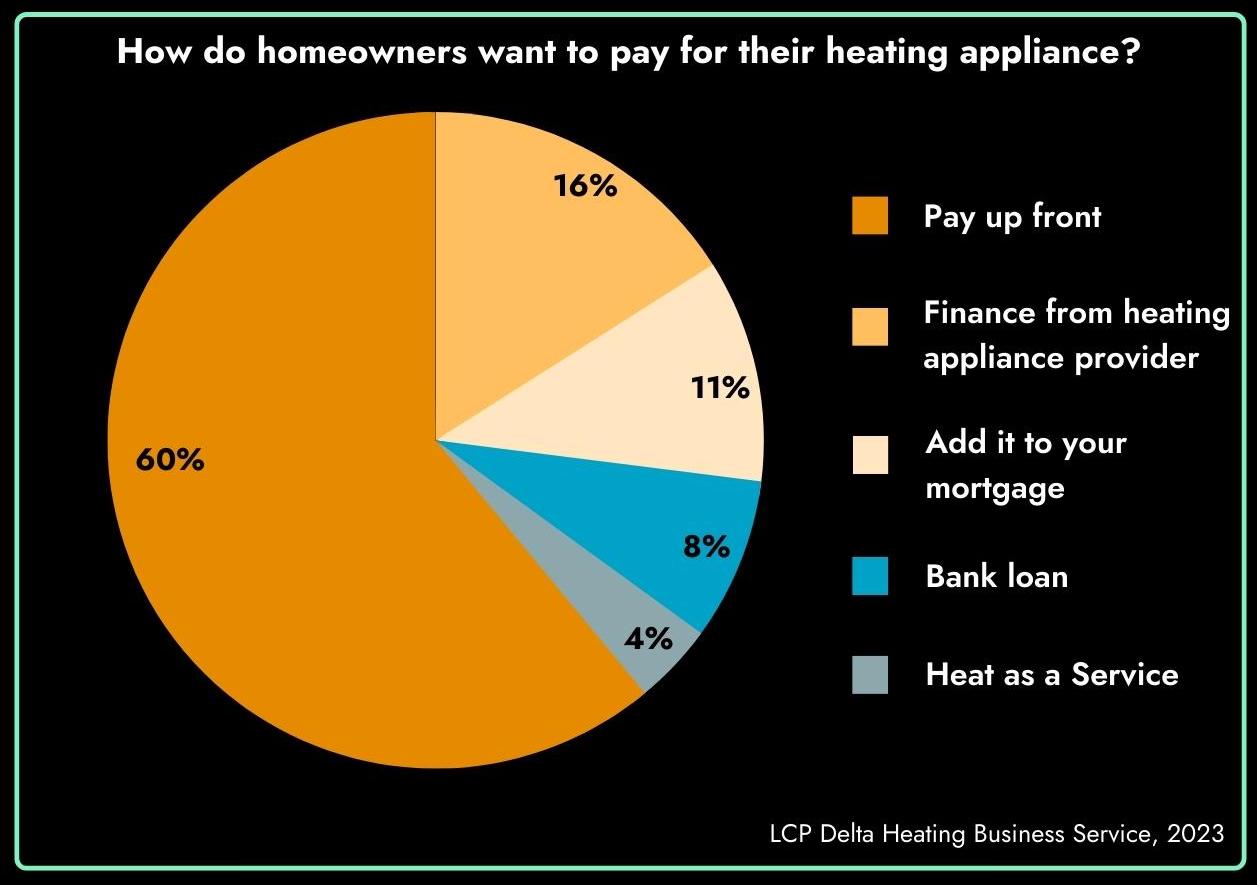

While renting a heating appliance can make more expensive heating appliances available to a wider audience, there are also other options to avoid upfront cost. These include payment plans offered by a supplier (typically with zero or low interest over 2-5 years), incorporating the cost into an existing mortgage, or conventional bank loans. According to our most recent customer research undertaken earlier this year, in 5 of the biggest European markets (DE, FR, UK, NL, IT), alternative finance methods are more appealing to customers than HaaS. HaaS is seen as a more expensive option, and customers are uncomfortable with not owning their heating system. Across these 5 markets, only 4% of homeowners surveyed would buy their next heating appliance under a Heat-as-a-Service contract.

LCP Delta believes that the benefits and ‘value’ of HaaS for residential customers are not clear enough in comparison to other finance options. Heating installations are in many cases not perceived as complex enough to justify the premium price of HaaS contracts. However, if other products are integrated and required to work together, i.e. energy as a service, then the ‘service’ element and peace of mind guaranteed by a specialist provider become increasingly significant.

Commercial and Industrial

The barriers to implementing HaaS in commercial and industrial sectors have largely been addressed, and adoption is expected to grow. For customers who generally do not want to input the capital required to invest in heating infrastructure, HaaS makes economic sense. Demand for HaaS is also stemming from increasing regulatory pressure and growing customer awareness.

“Barriers to implementing HaaS in commercial and

industrial sectors have largely been addressed,

and adoption is expected to grow.“

The main barrier lies on the supplier side. Targeting commercial and industrial customers can make risk management easier by limiting the customer base, however supply chain and risk management aspects are not fully developed. Suppliers must coordinate with manufacturers, logistics providers, and service technicians for the installation, maintenance, and ongoing management of heating systems. Timely access to spare parts and equipment is crucial, and effective risk management is necessary to handle breakdowns, maintenance costs, and financial risks associated with service agreements.

What is the current state of the emerging Haas space?

Today some of the most common HaaS models in the residential segment, include appliance rentals for gas boilers and heat pumps. Examples include thermondo and Viessmann in Germany, Feenstra and Nefit Bosch in the Netherlands and BeWarm and Warmly in the United Kingdom. In France, providers like Engie Home Services and izi by EDF have chosen financing options rather than rentals. These types of propositions are increasing in the UK, with some of the large energy retailers like E.ON and British Gas offering payment plans for heat pump purchases. British Gas have also recently announced a comfort guarantee for all of their heat pump installations ‘warm home promise’, ensuring customers get their money back if the heat pump does not perform as effectively as a traditional gas boiler.

The most notable development in the residential sector comes from banks interested in lending towards new energy solutions to decarbonise their portfolios. This is producing more attractive financing options, including cashback offers or reduced interest rates for eligible properties and we are starting to see partnership between banks and energy providers. For example, in the UK, Lloyds Banking Group and Octopus Energy offer loans to purchase heat pumps.As for the industrial sector, heat decarbonisation is part of the larger push to reach net zero targets. In Europe, energy performance contracts are commonly used, but there is a growing interest in energy services and “as a service” propositions due to rising energy prices. Major energy providers like Enel X, EOn, and Centrica offer fixed-price heat contracts while maintaining ownership and operation of heating systems. Notable trends include the development of a wider range of “as a service” propositions tailored to diverse industrial needs. Digital solutions such as OnGen in the UK can analyse building efficiency and offer recommendations which can simplify processes, reduce costs and improve efficiency. Furthermore, there is a shift towards comprehensive solutions that integrate all of a customer’s net zero requirements. While still rare in the market, Johnson Controls offers “Net Zero as a Service” taking care of financing, design, construction, and decarbonisation goals.

Where do you see a need for further research and understanding when it comes to HaaS?

There are several challenges linked to the development of HaaS propositions. For suppliers, a better understanding of the risks involved and how to design propositions that allow them to mitigate and manage those risks will be crucial to growing their business (for both residential and commercial/industrial). An interesting area for further development lies in identifying the additional services which could add further value to HaaS propositions. Services like remote diagnostics, optimisation and demand side flexibility are relatively uncommon, and the potential value of offering these services (for suppliers and customers) is yet to be determined.

There are also opportunities for further research to better understand the unique selling points for different customer groups. This is especially true for the residential market where reaching a wider residential customer base likely requires a range of propositions rather than a ‘one-size-fits-all’ approach. This could include a payment plan for those unable (or not wanting) to pay upfront, and a full package of services potentially including energy supply, for those able to pay a premium for peace of mind. Our research suggests however the latter is likely to only be a niche solution.

New synergies and solutions are also emerging from the financial sector’s focus on climate solutions, decarbonisation, and net-zero. As part of our Heating Business Service, LCP Delta plans to carry out customer research and analysis on residential customers’ preferences for certain types of green finance products. These products include green mortgages, appliance rentals/HaaS, and pay-as-you-save propositions. The objective is to gain a deeper understanding of customer concerns and attractive features associated with these products.

The global SET Alliance is dedicated to developing useful tools and materials for the development of the HaaS sector, such as standardised contracts, and will continue to engage with important stakeholders like LCP-Delta as the market for heating evolves. BASE also recently launched the Servetia Initiative, focusing on servitisation for building energy systems in Switzerland. As part of its activities the project will explore the current deployment and opportunity for further HaaS propositions, and the integration of other services such as renewable energy systems.

Did you find this content useful? Are you interested

in learning more about servitisation for the energy

transition and the work of the global SET Alliance?

We want to hear from you! Get in touch with us: