Industries across the board are transitioning from traditional ownership models to service-based approaches, such as Product-as-a-Service (PaaS) and Pay-per-Use (PPU). However, while these models offer financial and operational flexibility, they also introduce complexities in pricing, managing financial flows, tracking project performance, and ensuring smooth transactions. To support this transformation, specialised organisations and platforms are emerging as enablers, helping businesses build, scale and manage service-based financing models with ease.

One such organisation is Findustrial, which operates mainly in the DACH region (Germany, Austria, Switzerland), the UK and with a few customers already in the USA. Findustrial serves as a financial and operational hub, allowing businesses to bundle their products with services, price them, generate quotes for flexible PaaS and PPU models and manage IoT usage data, monitor projects and its profitability, and handle invoicing and the full integration to existing ERP systems in place.

By simplifying these processes, Findustrial empowers companies to unlock the full potential of service-based financing models, ensuring better cash flow simulation and management as well as long-term financial stability. We spoke to Julius Klemkow, Head of Products and Partnerships at Findustrial, to understand their work and gather insights.

Q1 – Expert Insight: What are the hurdles companies face when adopting service-based models, and how can companies like Findustrial help overcome them?

Transitioning to service-based models like Product-as-a-Service (PaaS) or Pay-per-Use (PPU) introduces several operational and financial challenges. First, cash flow uncertainty becomes a critical concern, as businesses shift from upfront sales to recurring revenue streams. This requires rethinking financial planning and refinancing, particularly for capital-intensive industries where upfront CapEx investments are traditionally the norm. Second, pricing complexity arises when balancing fixed and variable costs, especially in hybrid models that combine subscriptions with usage-based components. Third, data integration poses a hurdle, as legacy Enterprise Resource Planning (ERP) systems often lack the flexibility to process real-time IoT data or dynamic rating and billing requirements. Finally, performance tracking becomes more granular, demanding robust tools to monitor the asset’s financial health, profitability per project, and customer-specific metrics.

Findustrial addresses these challenges by acting as a financial and operational orchestrator. Its platform enables businesses to simulate cash flow scenarios under different pricing models, mitigating revenue uncertainty. For pricing, its Configure-Price-Quote (CPQ) module supports hybrid structures, allowing companies to test and simulate tiered subscriptions alongside usage-based rates. To bridge legacy systems, Findustrial’s API-first architecture ensures seamless data flow between Findustrial, ERP and CRM tools. By centralising asset performance analytics, the platform also provides real-time visibility into project ROI, empowering businesses to optimise dynamically.

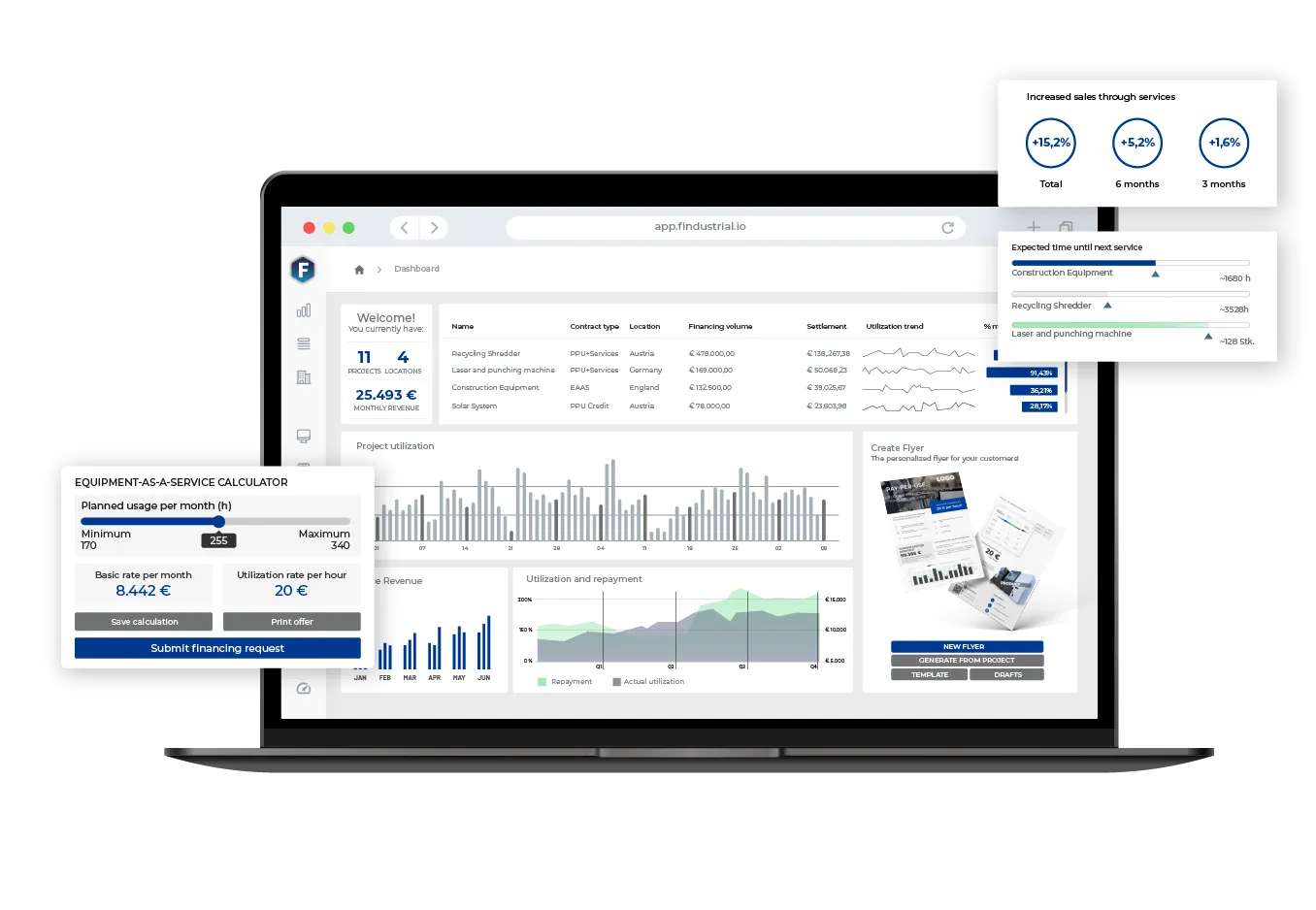

A snapshot of Findustrial’s platform.

Q2 – What role do digital platforms play in scaling Product-as-a-Service and Pay-per-Use financing across different industries?

Digital platforms are the backbone of scalable PaaS/PPU models, as they standardise and automate manual processes while accommodating industry-specific needs. In manufacturing, for example, platforms enable asset lifecycle management by tracking equipment usage and maintenance cycles, critical for aligning financing terms with operational realities. For energy-intensive sectors, platforms integrate IoT data to dynamically adjust repayment schedules based on real-time production metrics, as seen in Findustrial’s Solar-Flex model.

A key advantage of digital platforms lies in a quicker go-to-market for PaaS/PPU models. Platforms like Findustrial support cross-industry scalability of mission-critical activities like bundling, pricing, quoting and financial simulation: the same platform can manage Autonomous Mobile Robots (AMR) fleets for intra-logistics providers (e.g., Agilox’s Movement-as-a-Service) while handling solar energy PPU contracts, thanks to modular architecture. Additionally, digital platforms for PaaS/PPU models facilitate automation of invoicing and reconciliation by linking usage data directly to rating and billing systems, reducing administrative overhead.

Q3 – How is Findustrial leveraging these digital technologies? What are your solutions and what do they enable?

Findustrial’s solutions revolve around three pillars: Configure-Price-Quote (CPQ), CapEx-to-OpEx refinancing and financial simulation and monitoring, all underpinned by seamless ERP integration.

- CPQ Engine: The platform allows businesses to bundle products with services (e.g., maintenance, software updates) and price them using hybrid models. For instance, a manufacturer might offer a base subscription fee plus a per-unit usage charge, with tiered discounts at volume thresholds. The CPQ tool generates customer-specific quotes in seconds, reducing sales cycles.

- CapEx-to-OpEx Refinancing: By partnering with financial institutions like Erste Group and many more, Findustrial helps equipment manufacturers convert upfront asset costs into operational expenditures for their customers. This is achieved through financing structures, where repayments are tied to asset utilisation data, mitigating lender risk.

- Financial Simulation and Monitoring: Companies can model scenarios such as fluctuating demand to optimise pricing strategies, ensuring liquidity during low-yield periods. This data also feeds into refinancing agreements, ensuring terms align with actual asset performance.

Critically, Findustrial ensures compatibility with systems like SAP or Microsoft Dynamics, avoiding costly manual administration.

Q4 – Findustrial looks back to a long-standing partnership with Austrian biggest bank, Erste Group, where you have implemented a Pay-per-Use financing model, can you tell us more about the project?

A key example of how platforms facilitate the shift to service-based models is Findustrial’s partnership with Erste Group to implement a pay-per-use financing model for Backwelt Pilz, a leading industrial bakery in Lower Austria. Through Findustrial’s Solar-Flex financing, the bakery only pays for the solar power its system actually produces,no fixed repayment pressure. This means flexibility even when production varies, and most importantly: the Solar-Flex €/kWh rate is much lower than grid electricity, so the bakery is saving money every single day. It’s a no-brainer way to cut energy costs without any upfront CapEx cost.

Findustrial’s work with Backwelt Pilz is just one example of how digital solutions make flexible financing models more accessible. Findustrial also builds on a strong partnership with Agilox, supporting them to build, scale and manage their Movement-as-a-Service model for Autonomous Mobile Robots (AMRs), streamlining the adoption of usage-based CapEx-to-OpEx models across industries. By offering a ready-to-use financial infrastructure, these platforms remove barriers to entry, allowing manufacturers, financiers, and service providers to integrate Product-as-a-Service and Pay-pay-Use models more easily and efficiently.

The Backwelt Pilz project, in partnership with Sparkasse.

Q5 – In what ways do you see sustainability and circular economy goals shaping the design and financing of service-based models, and how does Findustrial support this through digital innovation?

Service-based models are recognised as circular business models due to their strong alignment with circular economy principles. Instead of generating revenue through product ownership, they provide customers with access to a product’s function. This shift fundamentally changes business incentives: the longer and more efficiently a product performs, the more value it generates over time. As a result, it is in the provider’s interest to consider aspects such as durability, maintainability, and reuse, in order to maximise a product’s useful life while reducing waste and resource consumption. This fosters innovation and collaboration across the value chain to deliver smarter and more sustainable solutions. It also responds to growing customer expectations and requirements for greater environmental responsibility and transparency around products and services they use.

Findustrial is supporting the transition through its digital platform and expertise in business model transformation, financing, risk management, legal structuring, marketing, and service activation reducing complexity and unlocking value for both manufacturers and financiers adopting circular, service-based models.

Although the financing landscape for circular models is still evolving, the enhanced operational insight and transparency enabled by service-based approaches can help unlock access to financing tools such as leasing arrangements, refinancing schemes, and green bonds.

Looking Ahead

As businesses increasingly adopt service-based strategies, platforms like Findustrial will continue to play a crucial role in facilitating their success. By providing essential tools such as product/service configuration, bundling, pricing, financial simulations, rating and billing, and real-time project tracking, these platforms ensure that companies can manage complex financial flows with minimal friction.

With digital platforms reducing the complexities of financial management, service-based business models may be seen as a more viable and scalable option. The question now is: How will businesses leverage these solutions to drive further innovation, and what new opportunities will arise as financial flows become increasingly automated and integrated?